The Goods and Services Tax (GST) rate applicable to hotels in India depends on the room tariff.

As of September 22, 2025 - the GST rates for hotel rooms are as follows:

- 0% GST for rooms with a tariff below ₹1,000 per night.

- 5% GST for rooms with a tariff between ₹1,001 and ₹7,500 per night.

- 18% GST for rooms with a tariff above ₹7,500 per night.

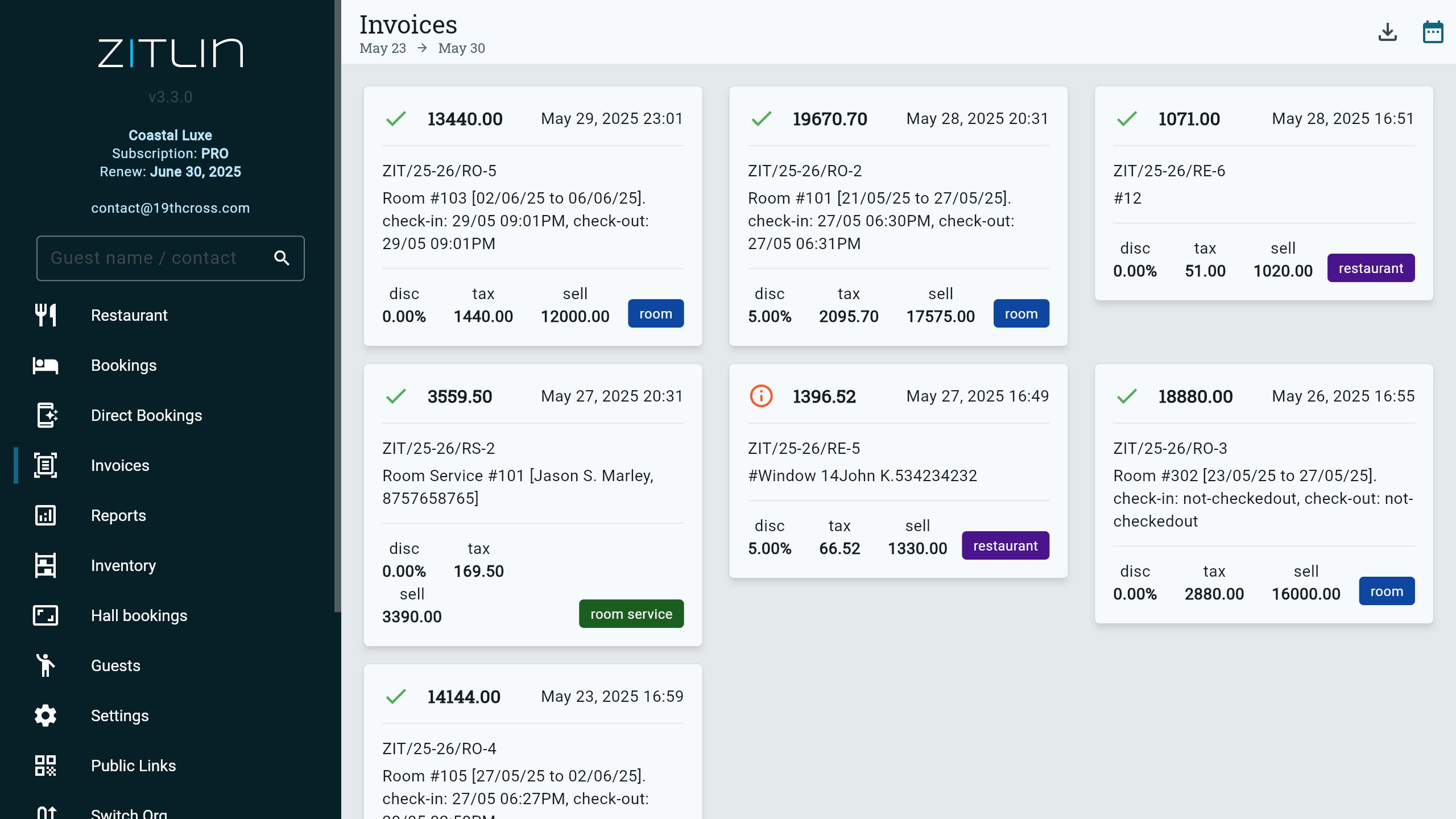

GST enabled accounting and invoicing with Zitlin

Free for small businesses, education and non-profits

Get Started

Additionally, some states in India have implemented their own tax rates on hotel bookings, which may vary from the central GST rate. For example:

- In Maharashtra, a state-specific luxury tax of 20% is applicable to luxury hotels.

- In Karnataka, a tourism tax of 1-3% is applicable to all types of hotels.

GST for hotel rooms

| Room tariff per night | GST Rate |

|---|---|

| Less than 1,000/- | 0% |

| 1,001/- to 7,500/- | 5% |

| More than 7,500/- | 18% |

GST for restaurant food

| Type of restaurant | GST Rate |

|---|---|

| Standalone restaurants with takeaway | 5% |

| Restaurant within hotels (room tariff is less than 7,500/-) | 5% |

| Restaurant within hotels (room tariff is more than or equal to 7,500/-) | 18% |

Note: The GST rates mentioned above are subject to change, and the actual tax rate may vary depending on the hotel's classification and location.