In Mauritius, hotel taxes are a crucial part of the hospitality industry. Here's an overview:

Tourism Levy: Introduced in 2013, this is a mandatory tax imposed on all tourist accommodation providers (hotels, guesthouses, self-catering apartments, etc.). The levy is paid by tourists through their accommodation bill.

- Rate: 2% of the total accommodation bill (excluding VAT)

- Exemptions: Certain categories of accommodations, such as those classified as "low-cost" or "budget-friendly", may be exempt from this tax

Value-Added Tax (VAT): Mauritius has a general rate of 15% VAT on all goods and services, including hotel stays.

- Rate: 15% of the total accommodation bill

- Exemptions: Some specific services, like health and medical services, are exempt from VAT

Other Taxes: There may be additional taxes or fees applicable to hotel bookings in Mauritius, depending on the type of accommodation and services offered. These might include:

- Service charge (5% - 10%) for food and beverage services

- Municipal tax (varies by location) for certain accommodations

- Environmental levy (varies by provider) for eco-friendly initiatives

Tax Inclusions: Some hotels may already include these taxes in their rates, while others might not. It's essential to check with your hotel or accommodation provider before booking to understand what taxes are included and how they will be charged.

Zitlin brings you 0% commission UPI based hotel Booking Engine

Free for small businesses, education and non-profits

Get Started

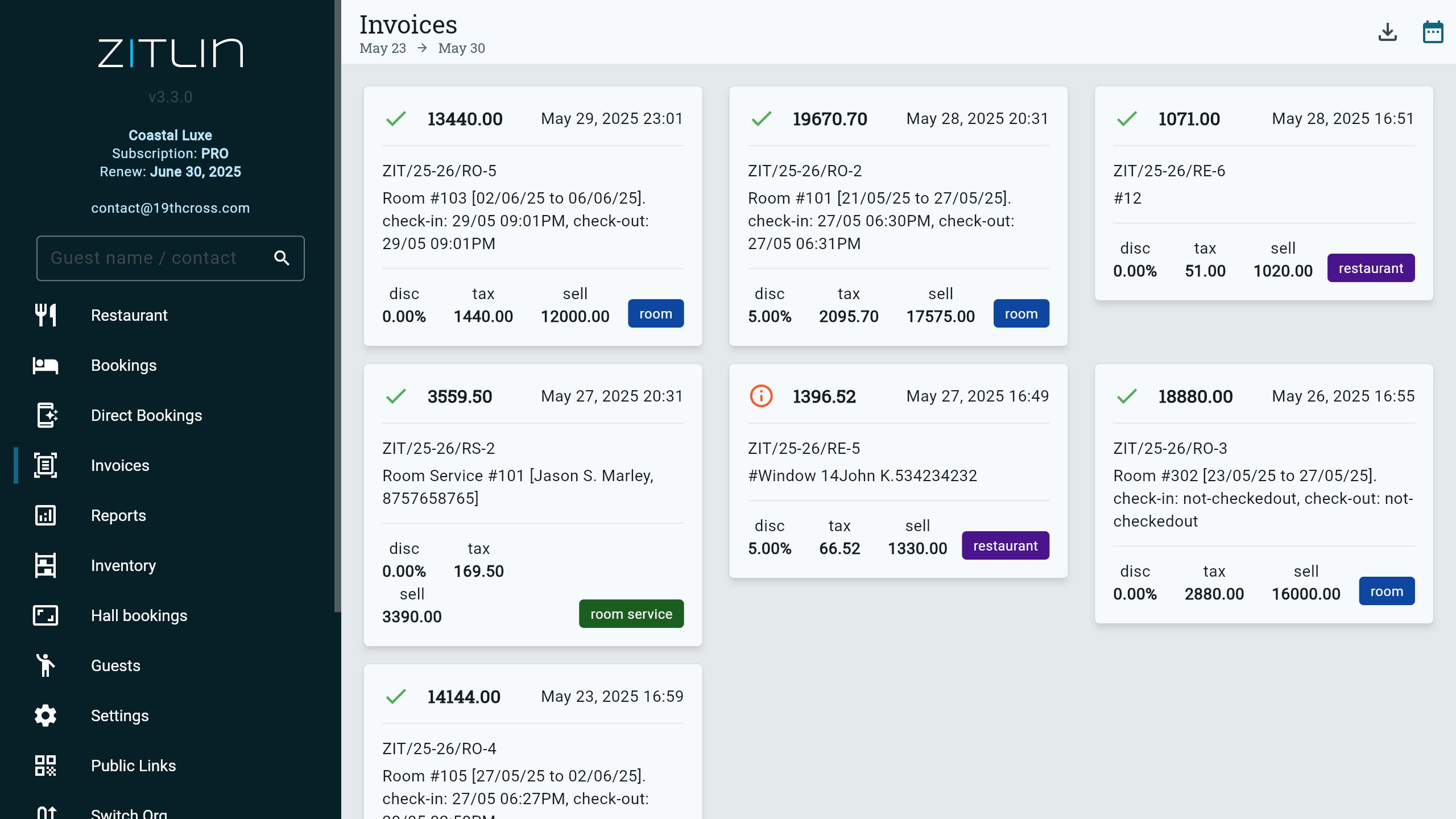

To give you a better idea, here's an example:

Let's say you book a 5-star hotel in Mauritius for 3 nights at $200 per night (total: $600). The total bill might include:

- Accommodation charge: $600

- Tourism Levy: $12 (2% of $600)

- VAT: $90 (15% of $600)

Total bill: $702

Please note that tax rates and structures are subject to change.