The Maldives, with its breathtaking beauty and luxurious hospitality, continues to be a global tourism hotspot. However, running a successful hotel or restaurant in this paradise comes with its own set of challenges, particularly when it comes to understanding and managing local taxes. Staying compliant with Maldivian tax laws is critical for avoiding penalties and ensuring the long-term financial health of your business. And that’s where a robust Property Management System (PMS) like Zitlin can be a game-changer.

The Challenges of Tax Compliance

Manually calculating and reporting these taxes can be incredibly complex and time-consuming. Common pitfalls include:

- Incorrect Calculation: Errors in calculating tax amounts can lead to penalties and audits.

- Delayed Reporting: Missing deadlines for tax submissions can result in late fees and legal issues.

- Lack of Visibility: Difficulty tracking tax-related data across different departments can hinder financial analysis and decision-making.

- Integration Issues: Managing taxes effectively requires seamless integration between your PMS, point-of-sale (POS) system, and accounting software.

Understanding the Maldivian Tax Landscape for Hotels & Restaurants

Free for small businesses, education and non-profits

Get Started

How Zitlin Streamlines Maldives Hotel Tax Management

Zitlin is more than just a PMS; it's a comprehensive solution designed to simplify your operations and ensure tax compliance. Here's how it can help:

- Automated Tax Calculation: Zitlin automatically calculates GST and TGST on room sales, F&B charges, and other services based on pre-configured tax rates. This minimizes calculation errors and saves valuable time.

- Customizable Tax Settings: Easily configure tax rates and rules to reflect current regulations and specific service categories.

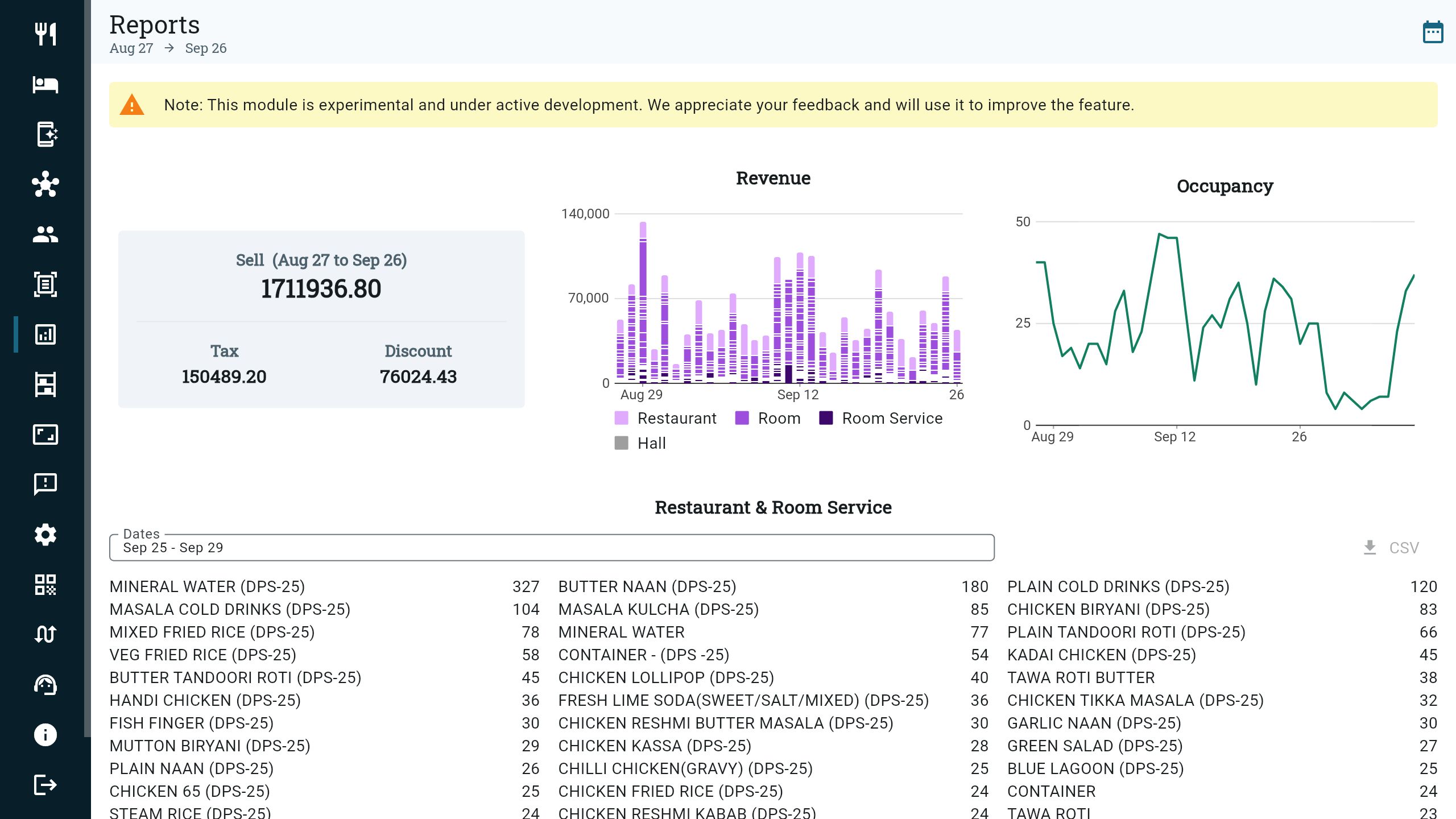

- Detailed Reporting: Generate comprehensive tax reports for GST, TGST, and other relevant taxes. These reports provide clear visibility into your tax liabilities and simplify reporting to the Maldives Inland Revenue Service (MIRS).

- Seamless Invoicing: Zitlin's invoicing module automatically includes applicable taxes on guest bills, ensuring accurate record-keeping and reducing the risk of disputes. You can customize invoice templates to reflect your brand and comply with regulatory requirements.

- Integration with Accounting Software: Zitlin integrates with popular accounting software like Xero, QuickBooks, and others, automatically exporting tax data and streamlining your accounting processes. This eliminates manual data entry and reduces the risk of discrepancies.

- Service Charge Management: Track and manage service charges effectively, allocating them appropriately for payroll and revenue reporting.

- Mobile Accessibility: Manage taxes and invoices on the go with Zitlin's Android and iOS apps, providing real-time visibility and control over your finances.

Beyond Compliance: Boosting Your Bottom Line

By automating tax management, Zitlin frees up your staff to focus on providing exceptional guest experiences and driving revenue. Improved accuracy reduces the risk of costly errors and penalties, while enhanced reporting provides valuable insights for optimizing pricing and profitability.