The luxury hotel market in South Asia and idyllic destinations like Mauritius is booming. High-net-worth travelers are seeking unparalleled experiences, pushing hoteliers to deliver perfection. However, behind the scenes of world-class service lies a complex web of financial regulations, particularly varying tax structures across countries. Managing these effectively is the key to sustainable growth and profitability.

The Challenge: A Labyrinth of Luxury Hotel Taxes

Navigating the tax landscape in this region requires precision. Each country has its own set of rules, which can be daunting to manage manually.

- India: Luxury hotels face a Goods and Services Tax (GST) of 18% for rooms with tariffs above ₹7,500 per night. Different GST rates for restaurant services and other amenities add another layer of complexity.

- Maldives: A Goods and Services Tax (GST) is the primary tax. Additionally, a Green Tax is levied per guest per night, emphasizing the nation's commitment to sustainability.

- Mauritius: Hoteliers must manage a Tourism Levy calculated on the accommodation bill, alongside a standard Value-Added Tax (VAT) of 15%.

- Sri Lanka: The tax system includes an 18% Value Added Tax (VAT), a 2.5% Social Security Contribution Levy (SSCL), and a 1% Tourism Development Levy (TDL) on turnover.

Manually tracking these diverse and fluctuating tax rates across multiple properties can lead to compliance risks and revenue leakage.

The Solution: Intelligent Automation with a Cloud-Based PMS

This is where a reliable, cloud-based Property Management System (PMS) like Zitlin becomes indispensable for luxury hoteliers. It transforms the challenge of compliance into an opportunity for efficiency and growth.

1. Automated & Accurate Tax Management Zitlin's accounting module can be configured to handle the specific tax laws of any country. It automatically calculates and applies the correct taxes—whether it's India's multi-slab GST, the Maldives' Green Tax, or Sri Lanka's TDL—to every invoice. This eliminates human error and ensures you are always compliant.

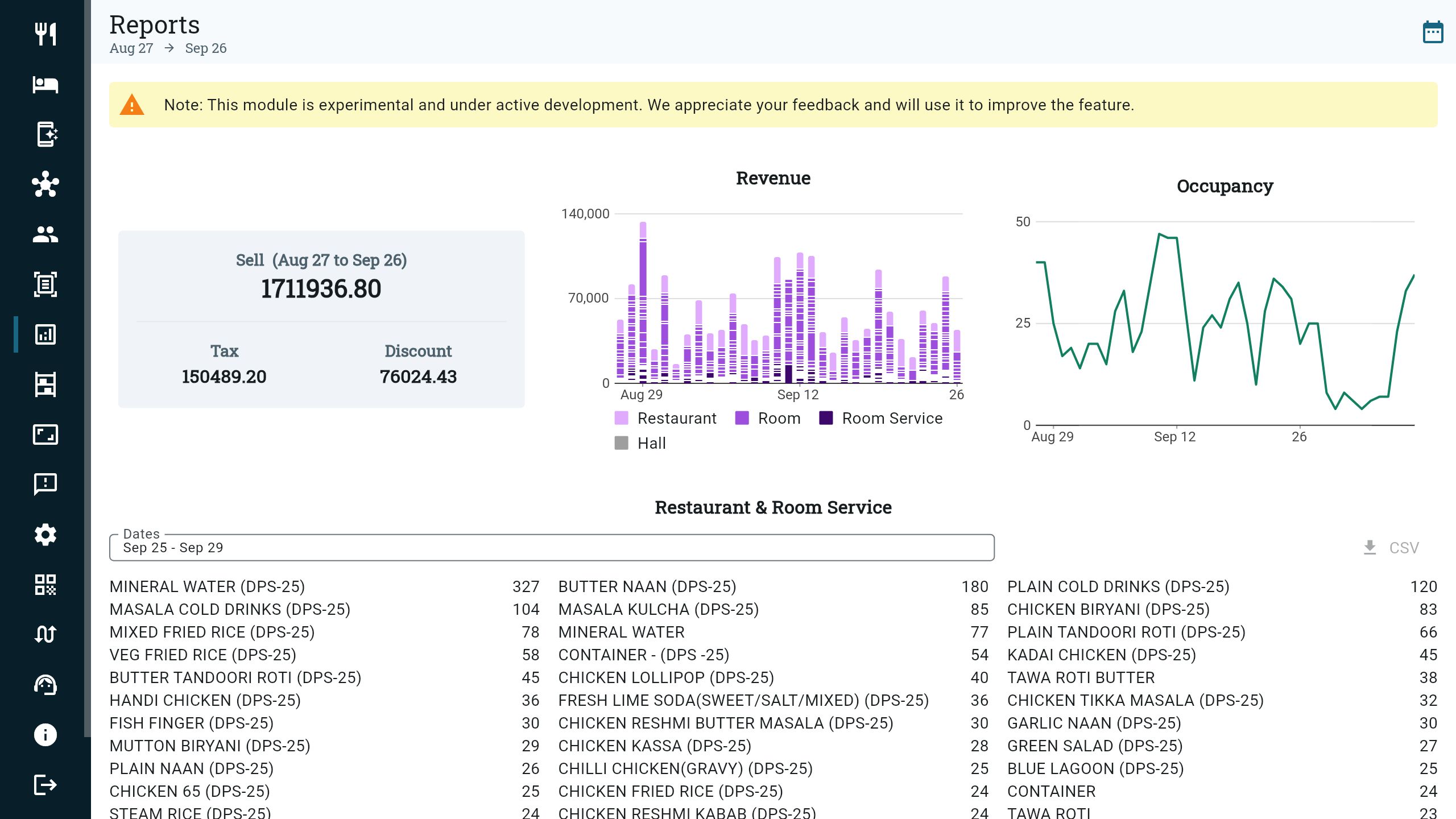

2. Seamless Multi-Property Management For luxury hotel chains with properties across different countries, Zitlin offers a centralized dashboard. You can monitor financial performance, manage bookings, and standardize operations across your entire portfolio from a single interface, all while respecting the unique tax regulations of each location.

3. Elevate the Guest Experience Luxury is defined by seamless service. By automating back-office tasks like accounting and inventory, your staff can focus entirely on the guest. Zitlin’s integrated Guest Relationship Management (CRM) allows you to track guest preferences and offer personalized experiences that build loyalty.

4. Drive Direct, High-Value Bookings Reduce dependency on high-commission OTAs. Zitlin’s integrated booking engine empowers you to drive direct bookings through your own website, complete with secure and convenient QR-based payment solutions for a modern, frictionless experience.

5. Actionable Business Insights Make data-driven decisions to propel your business forward. Zitlin provides powerful analytics and reporting tools, giving you a clear overview of revenue streams, occupancy rates, and operational efficiency, helping you identify opportunities for growth.

In the competitive luxury hospitality sector, efficiency and precision are paramount. By embracing a powerful cloud-based solution, you can master financial complexities and dedicate your resources to what truly matters: delivering an unforgettable experience for your guests.